Having responded to stronger-than-expected quarterly inflation figures by lifting the cash rate to 4.35 per cent in November, the RBA has used softer-than-expected monthly inflation data as an excuse to sit tight in December.

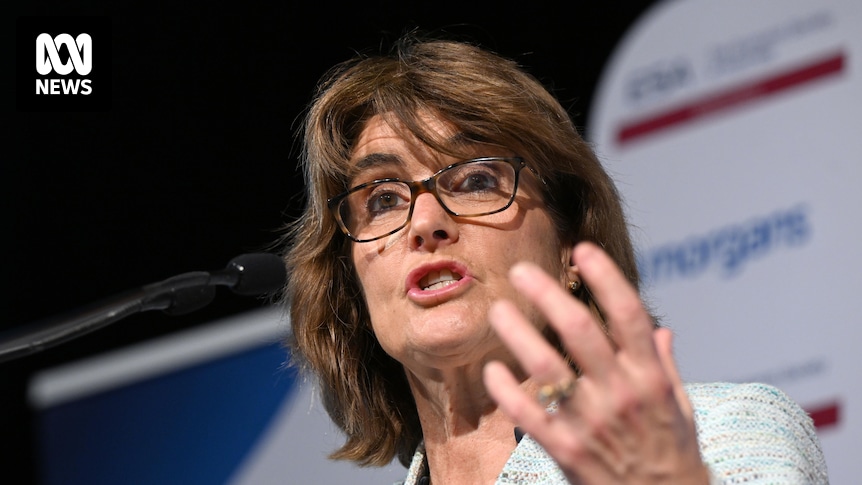

But RBA governor Michele Bullock noted that those October inflation figures covered mainly goods and few services, which are currently the main area of concern for the central bank, leaving it waiting for additional data.

“The limited information received on the domestic economy since the November meeting has been broadly in line with expectations,” Ms Bullock observed in her post-meeting statement.

With no meeting scheduled for January, borrowers should be safe from further rate rises until at least February.

(title changed from “Australians have endured the largest decline in spending power for four decades, so the RBA has decided to give them a break”)