CFPB is aware of the issue. I’m guessing that the incoming administration is not going to care about fees.

Drain it to zero and then let them auto close it for inactivity. Or keep it open forever since there’s no admin fee.

It’s an HSA, keep as much as you can in it. Use it for medical if you have too. Let it become functionally an IRA when you hit 65.

The admin fee is $0. Can you just transfer all of the money out and keep the account empty?

Does it benefit the company in some way to have empty accounts on their books?

I had this happen a couple jobs ago - I successfully spent it down to $1, but the they wouldn’t transfer that little. I suppose I may still legally have this amount somewhere

You can always just transfer it yourself. Withdraw it from a physical location (assuming there is one) for that bank and deposit it in your own hsa account.

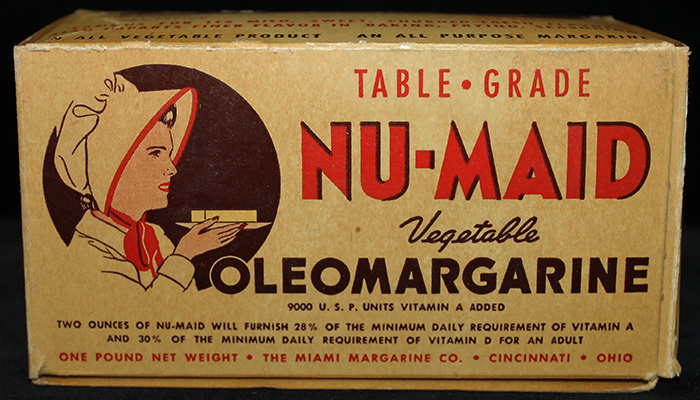

That schedule of fees looks like it’s straight from the 1980’s.

It deceives people whose idea of how things work in large companies hasn’t changed since the days when it was the manager of your bank branch who decided if you you should get a loan or not.

Nowadays, for certain in middle and large size companies, all the administrative main business pathways are heavilly if not totally automated and it’s customer support that ends up eating the most manpower (which is why there has been so much of a push for automated phone and chat support systems, of late using AI).

Those $25 bucks for “account closure” pays at worst for a few minutes of somebody’s seeking the account from user information on a computer, cross checking that the user information matches and then clicking a button that says “Close accout” and then “Ok” on the confirmation box and the remaining 99% or so left after paying for that cost are pure profit.

I found this bullshit out too recently.

Don’t pay it

eyup. had this twice. so annoying that jobs don’t let you choose an hsa for it to be deposited into.

deleted by creator

You don’t get it. It’s a health savings account.

They charitably contribute a whopping 0.05% APY to an account that drains to zero every year.

That’s FSAs.

HSA funds continue growing so long as you aren’t using them. If you’re healthy and actually middle class or better they act as a 3rd retirement vehicle, since after 65 you can use it for whatever and they don’t penalize you.

Exactly this, they’re best used as a tax free investment account rather than anything health related. If you’re on a plan with high enough a deductable to be eligible for an HSA and can afford it you should max out your HSA contributions before even a penny of unmatched 401k contributions. Personally I’d argue that you’re better off maxing out the HSA and using post-tax money to pay medical expenses unless close to the end of your career. It’s one of it not the single most easily taken advantage of ways to not pay tax at all on a long term investment.

The system is indeed stupid but the least you can do is take advantage of it where possible and for the middle class the HSA is one of the best ways.

Why is it better than unmatched 401k?

401k money is taxable as regular income on withdrawal. The expectation is you will be in a lower tax bracket after retiring, so you win.

HSA is not taxable, although I don’t know if that’s just when used for medical expenses

After 65 they don’t audit what you withdraw for.

My HSA interest rate is actually 0.01%

Are you not allowed to invest it? My HSA is invested in an ETF…

Of course, it’s not a massive menu of investment options but it has all the basics like SP500, target date funds, bond funds, dividend funds, etc. The cash portion, and it is literally called a savings account, is really bad rate, this 0.05% rate is really good compared to mine 😂. For my plan you have to keep at least $1000 in the savings account before you can invest.

Yeah, well don’t keep it in that part lol.

You are correct that if it drains to zero every year that is an FSA for sure

You know, I can look up the definitions of HSA and FSA and things like that, and I can have the definitions right there in a document on my screen, but they still don’t make any sense to me in terms of how they relate to me specifically. A lot of times they seem like they depend on me predicting things in the future that are unknowable, like my future health or how and where I will be billed for something. And that’s assuming I also look up related terms like APY and deductible and figure out what those mean. If I ask any HR people they’re like “just contact the provider for an explanation” and I’m like yeah, I totally want to deal with the phone menus and hold times of some faceless corporation, just to have them pull some BS like OP’s talking about.

Sorry about the rant. I guess that’s what I find mildly infuriating.

FSAs do depend on you kinda predicting or hedging bets against your own health since they only last the year. You can also use them to buy certain health/exercise equipment though.

HSAs can often be invested (in stock market) thus act like an IRA with extra tax avoidance if you manage not to use it for long enough. It’s counter to the stated purpose but it’s basically better to not withdraw or reimburse from it unless you need to.

Deductibles are Deductibles. How much you have to pay before insurance “kicks in”. There are per visit deductibles and yearly deductibles which are as they sound. HSAs are only available to plans with high deductibles. FSAs are available to plans that aren’t just high deductible.

I switched off of the family HSA plan after two years of paying out of pocket at the end of the term. It depends on the customer.

Regardless, the interest rates are abysmal.

Yes, but most HSAs let you invest in index funds so it becomes like another IRA.

You’re thinking of an FSA.