Says one bloke

This community would be greatly improved by banning Business Inshiter

So say we all.

Well it’s a backward looking model which explains why it aligns so perfectly with the last 2 recessions. There is certainly value to models like this, and all economic models should be based on data, but it really should show more than 20ish years of history. My guess is that it is only made based on those years, and it doesn’t fit the rest of history nearly so well which is why those years are omitted.

David Rosenberg is a perma-bear. He is trotted out like a circus pony every time a news organization wants to print a scary headline about the markets. His analysis offers nothing of distinct value because he does not change his opinion.

David Rosenberg has successfully called 86 of the last 3 recessions.

This is a useless article, written via the opinion of one of the most useless economists.

I find it fascinating that in English risk is always negative but chance isn’t always positive.

In my native language there’s a 15% chance that there won’t be a recession and an 85% risk of there being a recession.“chance” in my mind always means “less than likely”. Rather, if there is a “chance” of something, it is likely not going to happen.

I think the word you’re looking for in English that can have both a negative and positive connotation is “possibility” for a “less than likely” outcome… Its interchangeable with “chance” in most cases.

Is 85% less than likely in your opinion?

No. However, I thought you comment meant you interested in discussing the usage of English language in popular context and the oddities in which it was sometimes used. If you’re looking for absolute rules of language usage I’m not sure you’re going to find it.

Sorry, that sounds a lot harsher reading it than I meant for it to sound. In the context of the news article linked I found your less than likely funny. :)

If we’re speaking of personal feelings in how the words should be used then mine is that the possibility of an occurrence would be called a chance if I want it to occur, a risk if I don’t, unless the possibility reaches 100% or 0% as then it is no longer a chance nor a risk but a certainty.

99% chance you’re wrong.

I swear that website’s “journalists” just make shit up

Wait wasn’t this the mother fucker last week that said the next recession would be caused by poor people?

This is the best summary I could come up with:

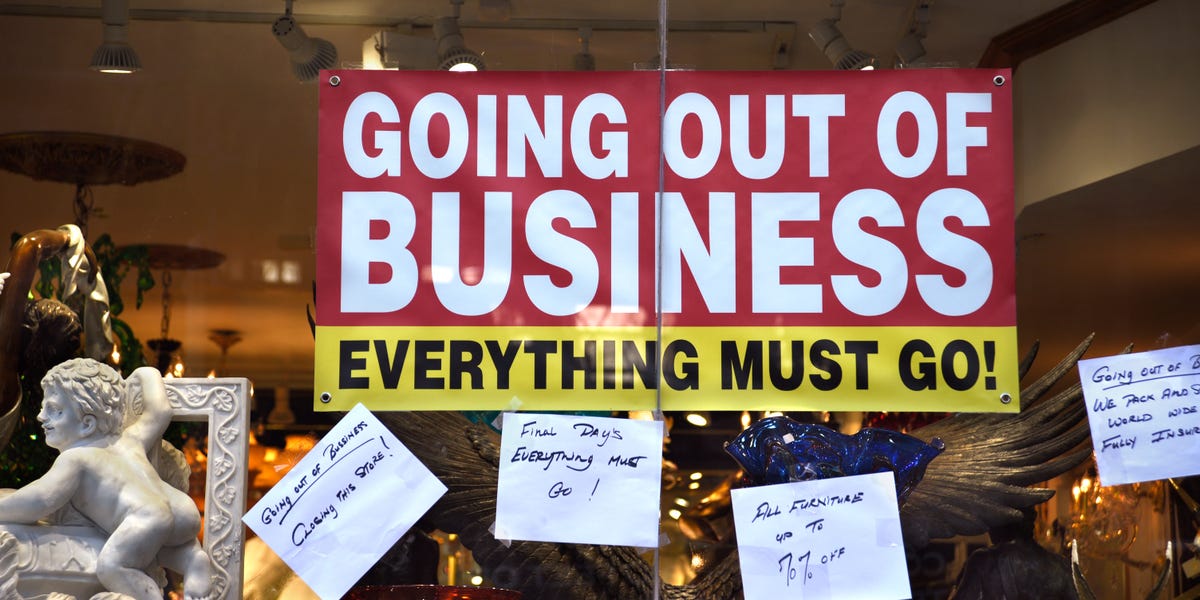

A recession is likely to hit the US economy in 2024, a new economic model highlighted by the economist David Rosenberg suggests.

The economic indicator, which Rosenberg calls the “full model,” suggests there’s an 85% chance of a recession striking within the next 12 months.

The model is based on a working National Bureau of Economic Research paper and consists of financial conditions indexes, the debt-service ratio, foreign term spreads, and the level of the yield curve.

“The full model predicted the ‘soft landing’ we saw in 2023 — but now is saying that for 2024, recession probabilities are highly elevated,” Rosenberg said.

The model utilized by Rosenberg also helps explain why the closely followed yield-curve indicator has so far been inaccurate in predicting a recession.

“It also explains why the yield curve didn’t work as a recession predictor in 2017-19: easy financial conditions, extremely low debt service obligations, and favorable foreign term spreads offset the signal from the inverted U.S. yield curve,” Rosenberg said.

The original article contains 338 words, the summary contains 164 words. Saved 51%. I’m a bot and I’m open source!

No it doesn’t. Have they ever been to a Costco?