I’m guessing it drives more profits

The idea is to get people used to visiting KFC.

Edit: I’ve been corrected in the comments. Happy to be wrong about this so thanks to the correctors.

Charitable donations can be written off on the businesses taxes, so by having customers pay for the donations it means the company gets to double dip. They write it off and the customer reimburses them for it.

Moral of the story: don’t donate to corporations. Give it directly to a charity.

What you’re describing just isn’t compliant with tax law in any jurisdiction I’m aware of.

Can you explain it to me? I’m just repeating what I’ve been told and I’m not a financial person.

Edit: nvm, I just read the other responders links.

Corporations: why spend our own money when we can get these chumps to spend it for us?

Donate directly to the charity and get Korean Fried Chicken instead.

The thing to keep in mind is that there exist things which have “circumstantial value”, meaning that the usefulness of something depends on the beholder’s circumstances at some point in time. Such an object can actually have multiple valuations, as compared to goods (which have a single, calculable market value) or sentimental objects (“priceless” to their owner).

To use an easy example, consider a sportsball ticket. Presenting it at the ballfield is redeemable for a seat to watch the game at the time and place written on the ticket. And it can be transferred – despite Ticketmaster’s best efforts – so someone else could enjoy the same. But if the ticket is unused and the game is over, then the ticket is now worthless. Or if the ticket holder doesn’t enjoy watching sportsball, their valuation of the ticket is near nil.

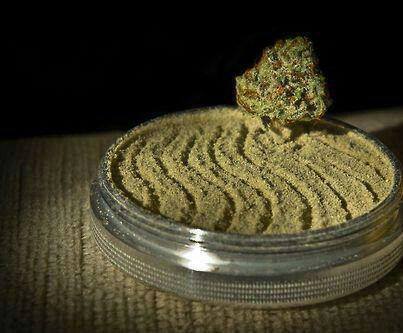

So to start, the coupon book is arguable “worth” $30, $0, or somewhere in between. Not everyone will use every coupon in the book. But if using just one coupon will result in a savings of at least $1, then perhaps the holder would see net-value from that deal. In no circumstance is KFC marking down $30 on their books because they issued coupons that somehow total to $30.

That said, I’m of the opinion that if a donation directly results in me receiving something in return… that’s not a donation. It’s a sale or transaction dressed in the clothes of charity. Plus, KFC sends coupons in the mail for free anyway.

Not everyone will use every coupon in the book

Most people don’t use most of the coupons. And the company bets on that, no matter what the *potential * value of the coupons is.

It’s the same with mail-in rebates. The promise of them can drive additional sales, but since 40-60% never get claimed, it’s just extra profits at the end of the day.

Coupons often drive sales for items that people usually wouldn’t buy themselves, sometimes even to people that normally wouldn’t shop there; then once they’ve tried something they haven’t had before, the customer is more likely to purchase that again in the future.

Then there’s additional items you add to the order beyond the coupon.

Finally there’s some rather insane profit margins on some of those items. Even with the coupon, they’re still making profit.

I know that on cake for example they’ve got a ~50% profit

never bothered to figure out the other stuff

In before “they’re just writing that off their own taxes” or “they’re already going to donate it and you’re just reimbursing them”.

Most of the ones near me just ask if you want to “round up” or make a static donation amount. I’m guessing the coupon book is nothing more than the coupons they’d send out in the weekly paper. Having received similar coupon books as “welcome aboard” gifts, most of those deals aren’t even all that good. Plus, they likely expire, so it puts a time rush on using them and draws in business.

“If everything’s above board that store really just acting like an agent,” said [Laurie Styron, Executive Director, CharityWatch]. “They’re really just taking your money and at some point in the future passing it on to the charity if they’re filing their taxes correctly. It actually doesn’t have any impact on that store’s taxes,” she said.

the others have described things well so read them first!

the irs looks at large charitable donations with suspicion because it is easy for a charity to pretend to do good but really just things the donars would do anyway but now they can deduct it. Thus large donars often have to do a match of smalaer donars as the large donation with no small donars suggests only the rich care and so maybe it isn’t really charitable.

remember the above is a factor in some cases but shoud be considered only after you exhaust the other reasons to do this and find they are not enough.

$$$$$