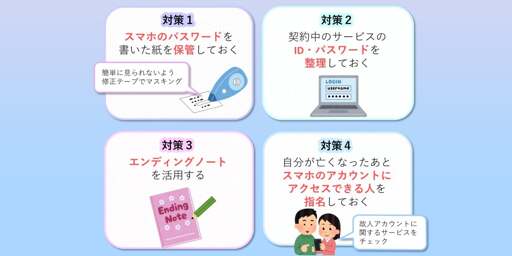

Japan’s National Consumer Affairs Center on Wednesday suggested citizens start “digital end of life planning” and offered tips on how to do it. The Center’s somewhat maudlin advice is motivated by recent incidents in which citizens struggled to cancel subscriptions their loved ones signed up for before their demise, because they didn’t know their usernames or passwords. The resulting “digital legacy” can be unpleasant to resolve, the agency warns, so suggested four steps to simplify ensure our digital legacies aren’t complicated:

- Ensuring family members can unlock your smartphone or computer in case of emergency;

- Maintain a list of your subscriptions, user IDs and passwords;

- Consider putting those details in a document intended to be made available when your life ends;

- Use a service that allows you to designate someone to have access to your smartphone and other accounts once your time on Earth ends.

The Center suggests now is the time for it to make this suggestion because it is aware of struggles to discover and resolve ongoing expenses after death. With smartphones ubiquitous, the org fears more people will find themselves unable to resolve their loved ones’ digital affairs – and powerless to stop their credit cards being charged for services the departed cannot consume.

That’s just good advice. Personally, I use a password manager.

Yeah. The only complicating factor is there are still some very stupid services that force periodic password changes (or at least I still have to deal with such stupid services with terrible password policies).

Password manager with a delegated access structure is the way to go. If my sister (who I have delegated to) requests access, provides a death certificate,and waits some cool-off period, she gets access to the portions of my password vault I designate. I will grant her access to my financials upon death, but not social media and private stuff.

Versus writing it down and giving it to a lawyer who probably has the same opsec as their 1920s counterpart.

Also are you going to update if every three months when you change your passwords? Writing it down gives only a false sense of legacy access that will likely never end up working

Let’s be realistic here. People ain’t changing their passwords every month, 3 months, even yearly.

Or ever. As recommended by NIST.

It’s not recommened to do anyway. So why bother if it’s random generated?

A lot of employers require this and people sync up their other passwords or if you’re like me, you average a change for many of your passwords every 6months or so simply because you are forced to change since you can’t remember the damn thing.

Can you please let us know what password manager does what you said?

You can self host Vaultwarden, which is essentially self managed Bitwarden.

And the feature can be setup fairly easily.

Okay, but if you’re self hosting it, then die, and the hosting has an issue during that time? You’re SOL.

Don’t try to self host things like a dead man switch.

The likelihood that I die, and my loved ones decide to just turn off the server while knowing it’s where the Vaultwarden software lives, before they get access to said Vaultwarden, is very very slim.

Self host whatever you want. Even Deadman switches.

The key is informing your loved ones the requirements for the switch. Just like if they don’t know to request access in other Deadman switches.

And if the hard drive goes out?

Cmon, you can’t tell me you’re comfortable with a 2 week “anything could happen” period where all that information could just disappear forever.

I can definitely tell you I’m comfortable with that.

If family doesn’t know I’m dead in 3 days, they ain’t family.

So it’s not actually one I would recommend. It’s provided as an employee benefit through my company, and I don’t particularly like my company having any relation to it at all.l and I don’t like the death certificate portion.

I’m moving back to BitWarden, which has a similar feature. It’s Emergency Access, in which your delegated person requests emergency access, there is a wait period where you would be getting emails or whatever notifying you of the access request, and if you don’t respond within the defined time period, access is granted.

So it removes the identification / death certificate portion, which I greatly prefer. My BW vault ties to an email address that I use only for the password manager, not my legal name or Social Security number, so I’m compartmentalizing pieces of identifying information.

Eh The things that actually matter, like phone, banks and utilities, and just about everything else, only require you tell them of the death. They might want proof such as a death certificate, but that’s normal.

The article mentions things like auto-payment subscription services which can definitely be a pain to deal with (even while you’re alive lol). Depending on how the payments are setup, it can be as easy as having the bank cancel the debit/credit card. For direct debit from checking accounts, though, it’s often a lot more complex to get stop payments on those (been there, unfortunately).

So leaving your account details (in a password manager, text file, notebook, etc) has some tangible benefits. At the very least, it makes it easier on your survivors to handle your affairs.

Strangely, I used to work for a bank in their “bereavement services” department; that is, the department that dealt with dead people’s accounts.

If anyone notified us of a death of an account holder, and provided any proof (death certificate, coroner’s report, police letter), the first thing we’d do is freeze the account. All payments out stopped, all cards cancelled, all withdrawals blocked. This was a legal requirement, because once somebody dies their money becomes the legal property of their “estate”, and it’s unlawful for anyone to remove money from the estate without following proper process.

There’s no need to stop each payment individually. In fact, the bank really doesn’t want you logging in to their online bank using the deceased’s credentials and messing around with things for the same reason; unless you’re following proper procedures, it’s not yours to mess with.

Possibly it’s different in different jurisdictions, of course.

Oh don’t get me wrong, i think it’s a good idea. Just be mindful that financial companies (for example) don’t think you’re in the account fraudulently. Tell them the person is deceased and then provide the account info you have.

And once you control the bank account, just put a stop payment on all of the subscriptions. What are they gonna do, put a negative mark on your dead relative’s credit score?

I could be wrong, but i think debt transfers to a relative.

Depends on the state and the type of debt. Have a mortgage? The bank will give the next of kin the opportunity to take over the payments. If they dont’t pay the mortgage, the bank will foreclose on the loan. But if Netflix comes after your kid for not paying your subscriotion fee after you die? They can fuck right off. At least, where I live.

Or they could be like Disney and deny something important because your cousins uncles grandfather had Disney+ for a week!

But I’m with you. Stop all payments.

Crap, i delete my first comment. Luckily i copied it right before, lol.

And once you control the bank account, just put a stop payment on all of the subscriptions. What are they gonna do, put a negative mark on your dead relative’s credit score?

This is a symptom of the absolutely insane way digital payments work.

You give a company your card details and they’re able to charge whatever they want, whenever they want, by default. That’s like paying at a restaurant by handing the waiter your entire wallet and telling them to take out the cost of the meal.