lol i wonder how much that is just guessing. they just coin flipped it

No source?

Thanks, Lemmy, now I’m “that Dad”. After reading this, I went to dinner with my two teens and one of their girlfriends, so of course I had to bring this up. All three have started working after school and will need to file their taxes this year so they need to know.

But holy crap is that a seriously uncool conversation

This belief is held by many older folks due to propoganda, and it is passed down to their children when their parents teach them about taxes. Since almost all younger folks use automated tax services, if they aren’t doing the math themselves, the fact that this isn’t true isn’t going to be discovered. I was taught the incorrect way when I was a kid, but noticed that it was wrong the first time I had to do my own taxes. But when I told my parents the way it actually worked, they didn’t believe me until I showed them the .gov site that breaks it down. I grew up in a small, blue collar town, and every single person I talked to about taxes parroted the same incorrect system.

How dumb do you have to be? By the time you make that much money you should, in theory, know the answer definitively or have a guy.

For someone outside the American tax system, can anyone put the difference in approximate numbers?

Your local tax system probably works the same.

That one dollar in the 33% bracket has .33 in taxes instead of .28. So their obligation goes up .05 per every dollar in the 33% tax bracket.

It boggles my mind how many people who have had to pay taxes for decades even, don’t understand how tax brackets work.

The only time you’ll get screwed on making more is if you were getting some sort of socialized assistance and you make a dollar over the cut off for aid.

Yeah, the Welfare Cliff is the only place where this happens and it’s unconscionable.

It is kind of by design to keep people from trying to get ahead at all

And to keep the private tax filing agencies afloat

And they’ll also refuse to believe you when you try to explain it to them

I used to be a supervisor at a psych hospital and had to regularly explain this to staff who were refusing overtime. They wanted to do it, sometimes desperately so because they needed the money, but they were utterly convinced that once they crossed 40 or 45k or whatever they would be taxed higher and make it all pointless. I felt like some just didn’t want to do ot, which was fine, but some legit keep meticulous records of their earnings to ensure they wouldn’t go over the line. I swore to them it didn’t work this way but they never believed me

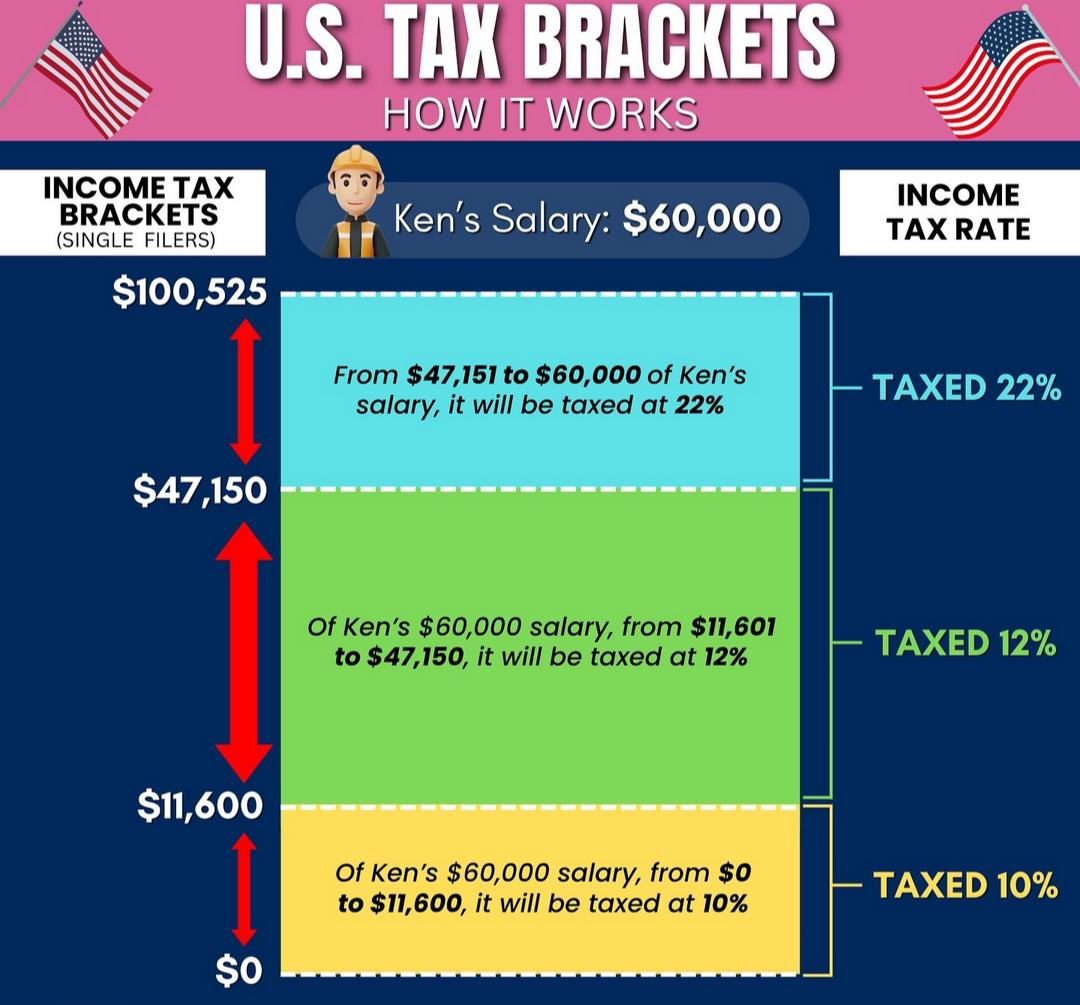

Should print out a poster infographic explaining progressive taxation and put it up on the wall in the break room

This infographic is kinda bad and would not convince someone who doesn’t know how it works at all

But you have to keep it going to highlight how much wealthier people pay (although that’s tougher since their income is not “income”). Maybe throw in a few examples of the wealthiest Americans and wha recent age they pay, to not only clarify it, but retarget their anger where it belongs

We covered how taxes are calculated at school, it isn’t very complicated. Yet SO MANY people insist they end up getting paid more it made me question myself for a while.

Although sometimes the removal of certain benefits does mean people can be worse off for £1 extra. Which if anything is just a sign that the benefits were poorly thought out and should taper off instead of being a hard limit.

There is probably sticker shock involved. Someone who gets a raise will see a new amount of taxes witheld and may be upset. It could even be they didn’t know what the amount taken out before taxes was.

The only way that’s a problem is if you’re on certain government benefits, if you make just a little bit too much there’s a hard cutoff for many benefits so you may end up losing more than you made in OT. But if your staff is facing this dilemma, they need to be paid more.

Short of doing a demo with rolls of change or MnMs or something, asking people to conceptualize math that is not just simple addition is often asking too much. Especially when people’s financial literacy is learned at home from people who retired in 1996.

If you ever wanted proof that a population that doesn’t understand math allows the billionaires to take advantage of them here it is. This is why education systems are under attack, because if you understood how taxes work you’d more likely support higher tax rates for the rich.

Probably the lead poisoning have something to do with it.

Some houses still have lead, to this day.

I know because my city recently passed a law requiring landlords to inspect rentals for lead paint, because a lot of kids are still getting lead poisoning.

(Its Philly btw)

To be clear for those unaware, you pay the lower bracket rates for the amounts earned in that bracket and the higher bracket rates for the amounts earned above that bracket.

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

This is actually not true as it doesn’t take into account the standard deductionIt does not take into account a lot of things, namely the many many deductions for qualifying individuals.

Not all people take the standard deduction, this is true before all deductions and similar economic stimuli.

I’m more concerned about the third of dems who don’t understand this.

it’s in the shitpost community and there’s no sources cited

I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

My tired brain read your comment as “shitpost economy” and somehow that still made sense to me.

Oh

Hungary used to have a system, which worked like what the republicans imagined, which made “taxing the rich more” a widely unpopular move…

FWIW globally, there is the issue of “welfare traps”. Benefits for low income people are usually tied to income (or savings). Once income reaches a threshold, these benefits must be replaced with income. So a higher income may result in a net loss.

i dont understand, isnt this graph showing that 2/3 of democrats dont understand how taxes work vs only 1/3 of republicans? wouldnt correct mean that yes, your tax bill goes up?

The options were that your taxes go up by a small amount or substantially. The correct answer is by a small amount since you only pay higher taxes on the one dollar that you’re over.

oh i see now. thanks.

Nah, also you’re never going to lose out on income by making more money.

Like others said, the only possible exception is if you’re getting government assistance and get kicked off programs you’re in because you went past the cut off. So, as an example, let’s say you’re low income and you get vouchers for school. You could make enough money that you’re no longer eligible for that benefit but the amount you make over the cut off is less than what the benefit was.

But, that’s a specific situation. At no time will your taxes increase more than whatever additional income you’re getting. Period.

I’ve tried to explain that too many times now in my life and I’m not even that old. Just a lot of people are bamboozled by propaganda and lies.